The embedded systems that control vehicle tracking grow more sophisticated by the day.

Hope Bovenzi, Texas Instruments Inc.

The phrase “car of the future” often invokes thoughts about autonomous driving. But it is fair to also consider what it will be like as a passenger once our driving habits change. With free hands and relaxed feet, the daily commute will be transformed from a tedious grind to an opportunity for work, video chat or stream content guilt-free.

This is just one vision for the future of telematics in the connected car, and the possibilities are limitless. It is useful to review what we know about telematics today to get a glimpse of what’s in store for the future.

In the early 2000’s, eCall burst onto the scene offering safety and emergency assistance, and navigation to help drivers know where they’re going and provided welcome silence from backseat drivers. (We can all be thankful for this.) The basic idea of eCall is to install a device in all vehicles that will automatically dial for help in the event of a serious road accident, and wirelessly send airbag deployment and impact sensor information, as well as location coordinates to local emergency agencies. This technology was mainly driven by the European Commission E112 in Europe, the European Regions Airline Association (ERA) Global Navigation Satellite System (GLONASS) in Russia, and E911 in the U.S.

On March 31, 2018, the European Union (EU) made it mandatory for all new cars to include eCall hardware. What started as a basic cellphone and navigation device now seamlessly integrates over-the-air updates, predicting driving behaviors and communicating with other vehicles.

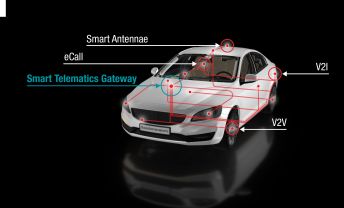

The market research firm Strategy Analytics predicts sales of telematics electronic control units (ECU) will grow at a 7.8% compound annual growth rate (CAGR) between 2017 and 2025. Expectations are that other infotainment platforms may plateau or see a sales deceleration over the same time frame. What’s worth noting about this prediction is that it only considers OEM and aftermarket telematics ECUs. It doesn’t consider the evolving trends in the telematics market such as vehicle-to-X (V2X), onboard diagnostics (OBD) port dongles and fleet management systems, or smart telematics gateways.

It’s important to identify new emerging trends in the telematics space. Today, the market is fragmented, and in many instances, it’s hard to know what comes first, the chicken or the egg (in the telematics space, the legislation or the infrastructure).

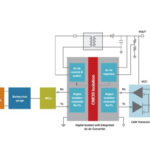

A secure telematics system is essential. The trend is to create a single point of entry into the telematics ecosystem: a gateway from the cloud to the car and an infrastructure network connecting all car subsystems. Telematics control units (TCUs) will evolve into smart telematics gateways with more integration. With the revenue potential for infotainment systems and connected cars – not to mention the thrill of the challenge –technology providers will continually raise the bar for themselves and the industry as a whole.

In the telematics space, every OEM and Tier 1 has their own variation of hardware. There are thousands of ways to build a TCU. However, all OEMs and Tier Ones face similar hardware design issues; whether it’s designing a backup battery, power supply, audio or a processor, there are many common design challenges in a telematics system. These challenges can vary depending on where the system resides in the vehicle.

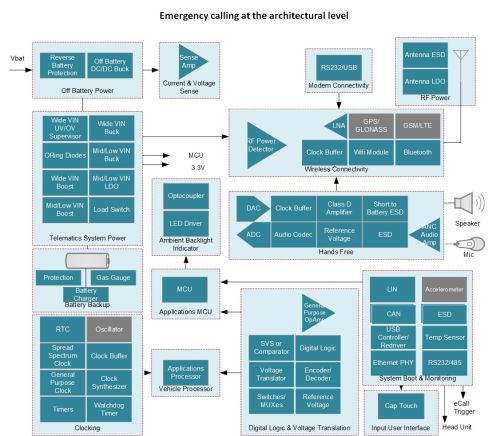

Consider the typical TCU with integrated eCall system. Requirements (if any) for such a system vary depending on region. The EU’s mandate requires an eCall system that can operate during and after a crash, automatically and without the car battery; withstand extreme temperatures (even -20 or -40°C), connect an eight-to-ten-minute phone call over a 10-year lifetime; place an emergency services call on the cellular network for 60 minutes; and comply with International Organization for Standardization (ISO) 26262 Automotive Safety Integrity Level (ASIL) A standards.

Backup battery

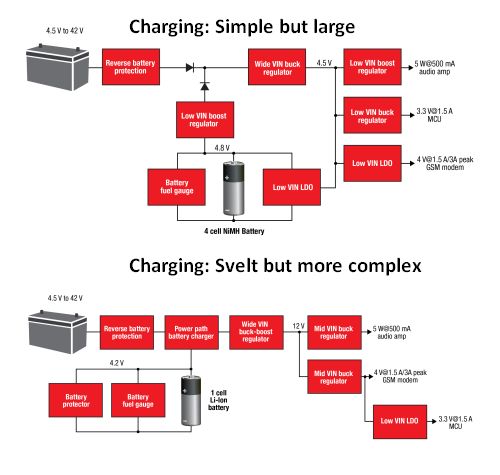

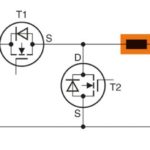

The backup battery is a good place to start when designing a TCU. EU requirements dictate a backup battery must support audio power anywhere from 6 to 20 W and peak currents from a Global System for Mobile Communications (GSM) module of around 2 A (nominally 350 mA).

The backup battery defines the rest of the system. Variables include the battery chemistry (common types include lithium-ion, lithium-ion phosphate, and nickel-metal hydride), the number of cells, and the current capabilities. Where the battery resides within the power path also defines the qualities of the charger or low-dropout regulator and whether there must be a boost regulator.

The choice of power regulators presents additional challenges. As with any automotive application, off-vehicle battery power must sustain harsh temperatures, wide input voltages, and it must include measures for electromagnetic interference (EMI) mitigation. Telematics systems may reside in areas of a car (windshield, passenger compartment, trunk, engine) that see high temperatures, so integrated circuit junction temperatures can rise to as high as 150°C. Good board thermals and high-efficiency power circuits are a must to keep temperatures within tolerable levels.

Input voltages based on OEM load dump, reverse polarity and cold-cranking conditions vary, but typically start at 4.5 V with peaks up to 42 V. None of the switching regulators can interfere with AM and FM bands of the car radio, so the switching frequency must be either around 400 kHz (below the AM band) or 2.1 MHz (above the AM band and below the FM band). A switching regulator operating at appropriate frequencies, inclusion of dithering/spread-spectrum techniques, and optimized layouts are all key practices ensuring good EMI performance.

Similarly, requirements for audio power can vary widely. Some designers may choose a low-power system on the order of 4 to 6 W while other systems can be as high as 20 W. Besides monitoring power consumption and how it varies, speaker diagnostics and protection are critical for audio. There must be guards against open and shorted output loads and output-to-power and ground shorts, and audio circuits must incorporate typical automotive protection against short-circuits and load dumps, as well as temperature protection and monitoring.

There is sometimes confusion about what separates a stand-alone eCall system from a TCU. The key differentiator is the data communication outside of the unit. In other words, if it is communicating data, it’s a TCU; if it doesn’t communicate data and is essentially a cellphone for the car, it’s an eCall system. Of course, a TCU can have eCall functions, but an eCall system can’t have a TCU.

The functions that telematic systems provide have increasingly been integrated into one or two SoCs. Consequently, this concentration of circuitry has forced a drastic rise in the data rates of connections to head units or central gateways. Gone are the days when just CAN, LIN or even USB data communication could handle the load. These schemes have been replaced by 10/100Mbps and even 1 GMbps pipes.

All in all, it’s hard to anticipate trends in telematics because the technology in this area changes rapidly. Developments today range from simple aftermarket on-board diagnostic dongles to sophisticated V2X systems. There are plenty of design challenges, security concerns, infrastructure needs, and legislative dictates to keep design engineers busy.

Hey Lee, great post.

It is critical to have a secure telematics system. The current trend is to provide a single point of entry into the telematics ecosystem: a cloud-to-car gateway and an infrastructure network that connects all of the car’s subsystems. TCUs (telematics control units) will become smart telematics gateways with more integration as time goes on. Technology providers will continue to raise the bar for themselves and the industry as a whole, given the income potential for infotainment systems and linked automobiles – not to mention the pleasure of the task.